Investment advisory services offered through Global Retirement Partners, LLC, a registered investment advisor. Global Retirement Partners, LLC and Retirement Impact, LLC are separate and unaffiliated

© 2021-2024 Retirement Impact, LLC

At Retirement Impact, we specialize in Fiduciary Governance support for 401k and 403b Plans. Our clients come to us when they realize that their service providers are not giving them the help that they need to make an impact on their plan.

Like you, our clients are busy. Every day they have pressing issues that need to be dealt with and are critical to the operation of their business and take priority. They can not take the time to stop and focus on something that in their opinion is “doing fine.” As a result, they may let their plan linger, potentially with underperforming funds and excessive fees, knowing that their service providers could be doing more for them.

Their plan may not have been helping employees save for retirement and could potentially be a liability time bomb.

We developed our service model with the goal of eliminating the barriers that exist for companies to offer a top-notch retirement plan to their employees. When you hire Retirement Impact, you are hiring a long-term partner whose responsibility is to ensure that all areas of your plan are expertly managed so that you can go back to running your business and growing your company.

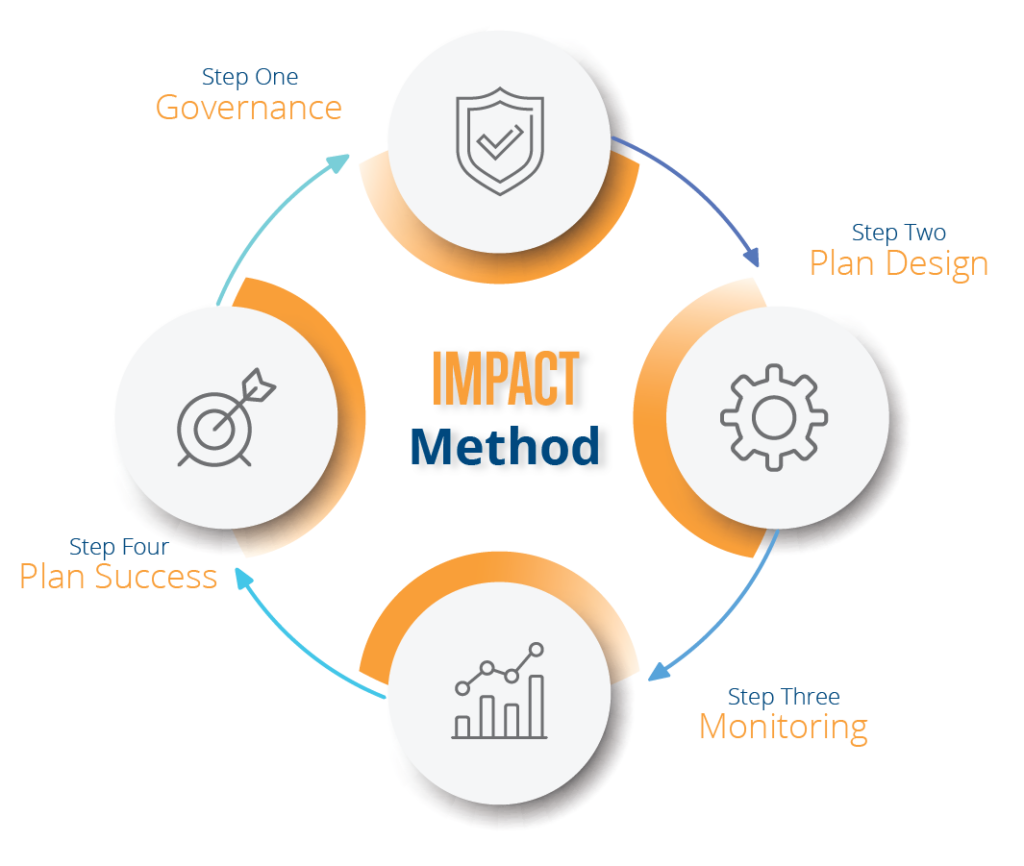

The Impact Method is a four-part cyclical process that provides a decision-making framework for fiduciary governance that helps ensures you are compliant with all aspects of ERISA regulations and that your participants have the best chance at a successful retirement.

Retirement Impact acts in a fiduciary capacity as it relates to the management of your investments. However, your fiduciary obligations go beyond investments and so does our service model. We act as your partner for all decisions that you make on your plan and act as a fiduciary when it comes to investment decisions so that we take responsibility for the decisions we make.

Our process starts with a thorough review of who the fiduciaries are to the plan and that they understand their obligations and liability. We then work with you to establish the goals and objectives for the plan. A committee will be established by the named fiduciary and by-laws will be drafted to inform the committee operations. Retirement Impact provides templates, for your consideration, for the necessary policies to be implemented including:

These policies document that you followed a thoughtful review process and that your decision making is in the best interests of plan participants when acting as a fiduciary.

Learn how your plan review process compares to best practices.

Plan design is the process of aligning your goals and objectives which we helped you identify in Step One with your operations and your Plan’s service providers. Here we focus on:

Service providers can include your TPA, Recordkeeper, Investment Providers and third-party education and ancillary service providers. We partner with industry recognized experts including Fiduciary Benchmarks, Inc. FIRM and fi360 to help you determine if any changes to service providers are required. If a change is necessary, we take the lead in performing a thorough RFP (Request for Proposal) process that identifies the best available service providers for your needs.

We take the lead on all plan changes to help you maximize the Impact of your plan while reducing the amount of time and expense spent administering your plan.

Our monitoring regimen is the backbone of our fiduciary process. Our team of credentialed fiduciary advisors prepares quarterly reporting for your investments and analytics on various aspects of your plan. Our monitoring process includes:

We help you automate many of the aspects of your plan monitoring so that you can be sure that your fiduciary obligations to the plan are being satisfied and your plan is having the IMPACT that you intended when you set it up.

The ultimate measure of how effective your plan is can be expressed by how well your employees can save for retirement. Plan outcomes are driven by various factors including savings rates, employer contributions, access to financial education and behavioral finance measures adopted by the plan.

Our approach measures participant outcomes and uses that information to guide plan design and manage plan resources to identify and make an impact on participants who are struggling.

Participant outcomes are at the core of our service model and regularly assessing outcomes allows us to frame all of our decisions in the best interest of plan participants as mandated under ERISA.

Investment advisory services offered through Global Retirement Partners, LLC, a registered investment advisor. Global Retirement Partners, LLC and Retirement Impact, LLC are separate and unaffiliated

© 2021-2024 Retirement Impact, LLC

| Cookie | Duration | Description |

|---|---|---|

| __cfduid | 1 month | The cookie is used by cdn services like CloudFare to identify individual clients behind a shared IP address and apply security settings on a per-client basis. It does not correspond to any user ID in the web application and does not store any personally identifiable information. |

| __hssrc | session | This cookie is set by Hubspot. According to their documentation, whenever HubSpot changes the session cookie, this cookie is also set to determine if the visitor has restarted their browser. If this cookie does not exist when HubSpot manages cookies, it is considered a new session. |

| _GRECAPTCHA | 5 months 27 days | This cookie is set by the Google recaptcha service to identify bots to protect the website against malicious spam attacks. |

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-advertisement | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Advertisement". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| CookieLawInfoConsent | 1 year | Records the default button state of the corresponding category & the status of CCPA. It works only in coordination with the primary cookie. |

| elementor | never | This cookie is used by the website's WordPress theme. It allows the website owner to implement or change the website's content in real-time. |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| __cf_bm | 30 minutes | This cookie, set by Cloudflare, is used to support Cloudflare Bot Management. |

| __hssc | 30 minutes | This cookie is set by HubSpot. The purpose of the cookie is to keep track of sessions. This is used to determine if HubSpot should increment the session number and timestamps in the __hstc cookie. It contains the domain, viewCount (increments each pageView in a session), and session start timestamp. |

| bcookie | 1 year | LinkedIn sets this cookie from LinkedIn share buttons and ad tags to recognize browser ID. |

| bscookie | 1 year | LinkedIn sets this cookie to store performed actions on the website. |

| lang | session | LinkedIn sets this cookie to remember a user's language setting. |

| li_gc | 5 months 27 days | Linkedin set this cookie for storing visitor's consent regarding using cookies for non-essential purposes. |

| lidc | 1 day | LinkedIn sets the lidc cookie to facilitate data center selection. |

| UserMatchHistory | 1 month | LinkedIn sets this cookie for LinkedIn Ads ID syncing. |

| Cookie | Duration | Description |

|---|---|---|

| __hstc | 1 year 24 days | This cookie is set by Hubspot and is used for tracking visitors. It contains the domain, utk, initial timestamp (first visit), last timestamp (last visit), current timestamp (this visit), and session number (increments for each subsequent session). |

| _ga | 2 years | The _ga cookie, installed by Google Analytics, calculates visitor, session and campaign data and also keeps track of site usage for the site's analytics report. The cookie stores information anonymously and assigns a randomly generated number to recognize unique visitors. |

| _ga_W776MBVZ10 | 2 years | This cookie is installed by Google Analytics. |

| _gat_gtag_UA_199052596_1 | 1 minute | Set by Google to distinguish users. |

| _gid | 1 day | Installed by Google Analytics, _gid cookie stores information on how visitors use a website, while also creating an analytics report of the website's performance. Some of the data that are collected include the number of visitors, their source, and the pages they visit anonymously. |

| AnalyticsSyncHistory | 1 month | Linkedin set this cookie to store information about the time a sync took place with the lms_analytics cookie. |

| CONSENT | 2 years | YouTube sets this cookie via embedded youtube-videos and registers anonymous statistical data. |

| hubspotutk | 1 year 24 days | This cookie is used by HubSpot to keep track of the visitors to the website. This cookie is passed to Hubspot on form submission and used when deduplicating contacts. |

| Cookie | Duration | Description |

|---|---|---|

| VISITOR_INFO1_LIVE | 5 months 27 days | A cookie set by YouTube to measure bandwidth that determines whether the user gets the new or old player interface. |

| YSC | session | YSC cookie is set by Youtube and is used to track the views of embedded videos on Youtube pages. |

| yt-remote-connected-devices | never | YouTube sets this cookie to store the video preferences of the user using embedded YouTube video. |

| yt-remote-device-id | never | YouTube sets this cookie to store the video preferences of the user using embedded YouTube video. |

| Cookie | Duration | Description |

|---|---|---|

| __tld__ | session | No description |

| cb_anonymous_id | 1 year | No description available. |

| cb_group_id | 1 year | No description available. |

| cb_user_id | 1 year | No description available. |

| cbtest | 1 year | No description |

| debug | never | No description available. |

| ln_or | 1 day | No description |

| pfjscookies | 1 year | No description |